Hello, beautiful people from across the lands. Today’s post is a difficult one to write as there is an inward battle to expose my shortcomings. Fear of judgment and shame lingers throughout my mind as I take a hard look at my current financial position and my deep debt amount.

6 minute read

The purpose of this blog is to inspire others by my story with transparency and tangible actions to create change. So yes, ya girl is in some serious mess!

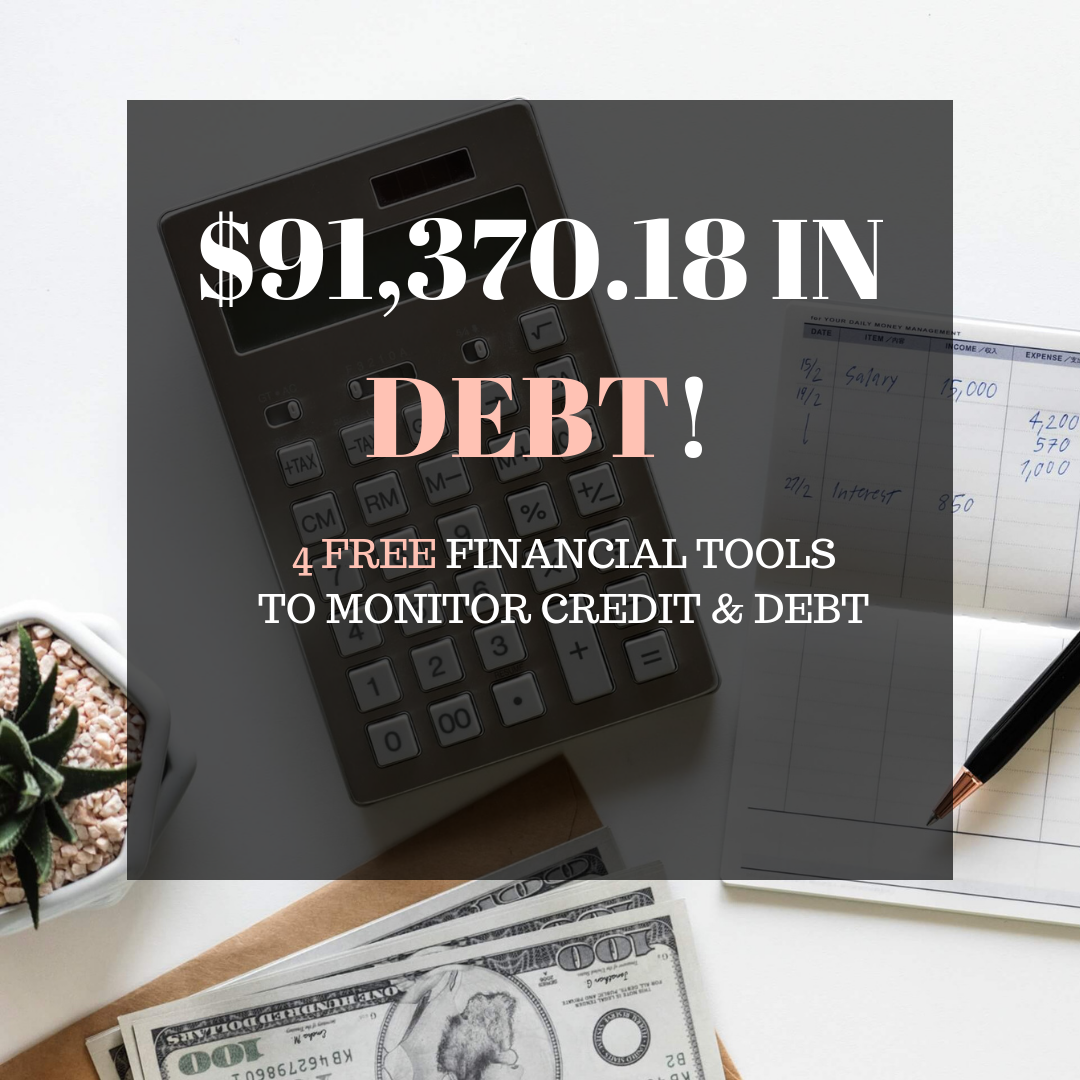

As you can see my debt total is currently $91,370.18 and my current credit score has me just scratching the surface of the 500 club.

How did I get here?

Well, let’s break this debt down.

Debt Break Down

- $80, 727 Student Loans

- $9, 272 Auto Loan

- $633 Collections

- $738.18 Pay Day Loan

Student Loans

As you can see, a huge chunk of my debt is due to student loans. I have a total of 3 degrees. I am all for higher education and do not regret my decision to seek it. The reality is it’s highly competitive and depending on your field of study you might have an outdated degree with low demand or less lucrative salary projections.

The job/career hunt can be brutal especially for those coming straight out of college.Some employers require 10 years of experience, a vital organ, and power over your soul. OK maybe I’m being a bit dramatic, but I know some of you feel where I’m coming from.

I mean does my education that is the most expensive investment I have, count for anything?! Demographics can play a huge role as well. Last November I moved from my hometown seeking better opportunities due to the constant struggle of finding respectable work.

A few months after my departure an article from USA Today was published listing my hometown as the number one worst place in the country for African Americans to live.

I am an African American, a woman, and a mom.

Auto Loans

I bought my 2009 Jeep two years ago around tax return time. Before getting this car, my old car was paid in full with refund money from school aka leftover student loans (I know, I know smh). The engine went out leaving me car-less for a year with two small children in one of the snowiest cities in America, Erie Pa!

So getting a car during one of the most surplus times of income was a must. I have not been able to manage the payments consistently during ruff financial stages in my life.

I still have the car and tried to get rid of it but even with a co-signer, the equity is too high. My credit score is too low for the dealership to take that risk. I’m not even going to get into the car repairs (holding aching head). Frustrating and embarrassing it may be a blessing in disguise.

Well, at least that’s what I’m telling myself to cope with the stress.

Collections & Payday loans

I have a few unpaid bills that have gone into collections a few years ago like cell phone, utility, and medical bills. Luckily, I don’t have anything I didn’t sign up for, it’s all my doing. There’s nothing worse than being held accountable for someone else’s poor financial decisions.

With the payday loan, I should have known better!

Crisis + desperation= poor financial decisions.

As you can see I do not have any credit card debt. I’ve always tried to avoid debt like a plague and credit cards just always seemed bad to have. I dive into my money mentality in this post. For me to take out a payday loan shows I was in serious hardship.

I am by no means excusing my decision because the reality is I have to pay the money. An essential reason why I must get started on this debt-free journey to make some changes.

Not Easy But Worth It

So, there you have it, my financial mishaps fully exposed. This was not easy to write let alone look at. I realize I have a huge mountain in front of me. Life has had its way of forcing me to not ignore or hide from it any longer.

Day by day and pay by pay that mountain will move.

~Hopeful Person

I encourage you to look at your starting point and figure out your debt number. It’s hard to get ready when you don’t know where to start. Below are some free tools that provided insight to my starting point.

Free Financial Tools

Credit Score Monitoring

It’s helpful to use all three to compare your credit scores plus Credit Sesame gives FREE Identity protection when you sign up!

This site allows you to pull your credit report from all three bureaus for free once a year.

I don’t recommend pulling all three at a time. (Currently offering free WEEKLY online reports through April 2021 from all three credit bureaus due to COVID 19)

It might work best to pull it every quarter to monitor your progress. (Now you can pull from one credit bureau per week until April 2021)

I hope sharing my story helps, feel free to leave a comment below sharing your starting point or helpful resources to monitor your finances.

Let’s embark on this journey together.

Until next time dream, believe, and achieve.