3 Impactful Ways to Utilize Your Tax Return

5 minute read

Hello, beautiful people from across the lands! Let’s talk about tax baby, let’s talk about that money! LOL if you heard Salt N Peppa voices while reading that, you’re funny! But seriously we all know around this time of year many are waiting intensely by the mailboxes for the golden ticket…W2’s!

With so much going on within the US government and the effects it may have had within various households, managing this large sum of money is going to be very important. Tax time is a completely different beast for business owners who must report them quarterly but that’s another blog for another day. Today I want to share three ways I plan to make the most with my tax return.

Save it!

Yes, this is a no brainier. It is important to be very stewardess with this large return of money. If you are following me along the journey to debt freedom you know Step 1 is to have $1,000 of emergency money saved. Now would be a perfect time to put that money up if you have not reached that goal (like myself) just yet. One in four American households does not have enough money put away to handle an unexpected expense of $400 or more without going into debt.

Having this emergency money put away can place you on the positive end of that statistic. I’ve joined a program that pays you to save! Yes, you read that right. While listening to a new-found favorite Podcast Paychecks & Balances I became aware of a nonprofit organization called EARN.org. EARN is a national nonprofit that helps working families achieve prosperity through savings. Right now they are encouraging families to pledge to save a portion of their tax return and in return will reward with CASH prizes.

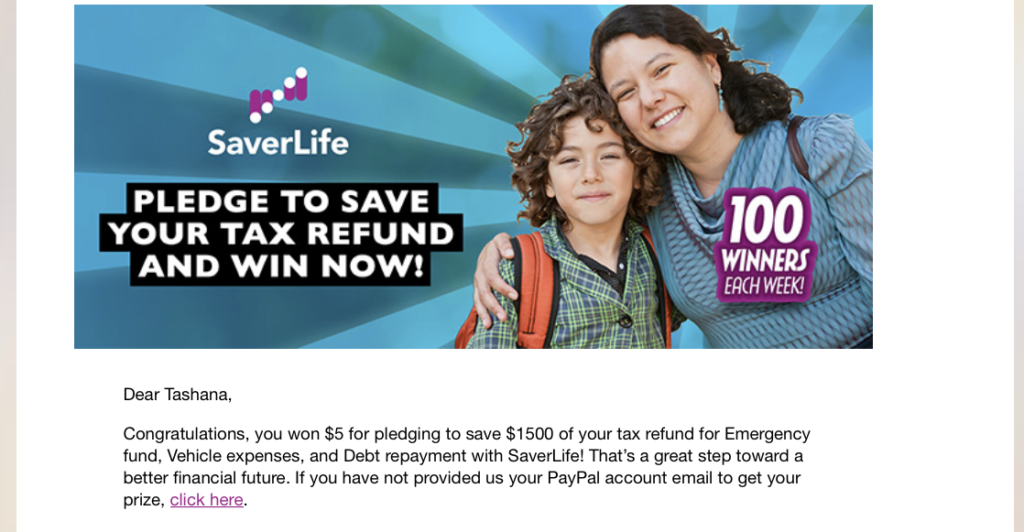

I signed up myself and just for pledging was rewarded with 5 bucks! Yes, I was happy about my five dollars in free money!! Please read image below. I brought receipts honey!

-

Saver Life Tax Refund Pledge

The money will come via Paypal so have your info ready or sign up for one today. Join me and take the pledge to get your 2019 off to a great financial start. Sign up for free here.

Pay Immediate Expenses

Life has a harmonious way of happening when you are not financially prepared. Allocate a portion of your tax return to catch up on past due bills, cover car repairs, and address any other immediate need that may have caused lots of stress without having the money. An immediate expense may vary from one household to another.

I would classify most immediate expenses as something that will begin to compound on itself or be removed from your possession if not paid (i.e cut off lights, heat, gas, car payment or repairs etc.). Now is the time to address as many as possible to keep expenses current.

Pay off debt!

The record that keeps on spinning. After you have saved and paid off immediate expenses your last step is to pay off some debts. Now, this portion of the Tax Refund is from leftover money that might otherwise be spent on things you don’t really need or serve no purpose toward your financial reality.

I am using the snowball method and will focus on my smallest loans first. I am hoping to be able to pay in full two of my smallest student loans. One is currently $973.09 and the other is $1,365.26 making my total payment $2,338.35 interest included. I do have some immediate expenses of my own I need to tend to in order to determine if this goal is feasible.

I am still waiting on ONE W2 to come in the mail.

Recap

It is important to manage this large sum of money wisely and give every dollar an assignment. In order to do that you must have a budget in place. Check out my budgeting series day one, day two and day three where I share basic strategies to formulate one.

- Save it! Add or complete your emergency fund goal

- Pay immediate expenses! Catch up on past due bills and meet immediate needs

- Pay off debt! After completing the first two with whatever is leftover allocate a nice amount to paying off debt making it one step closer to debt freedom!

Happy Tax Season! Until next time dream, believe and achieve.