Hello, beautiful people from across the lands! What a great way to start the week by talking about how your credit score is calculated! Just kidding lol but knowing your numbers is so important and knowing how those numbers are formed is equally important too. I think it is important to understand how your credit score is determined so you are informed on how to improve it. There are a lot of paid services that can do the work for you which is fine. However, if you never learn from your mistake you are highly likely to repeat. Let’s break down how to understand your credit score in these quick and simple categories.

Payment History

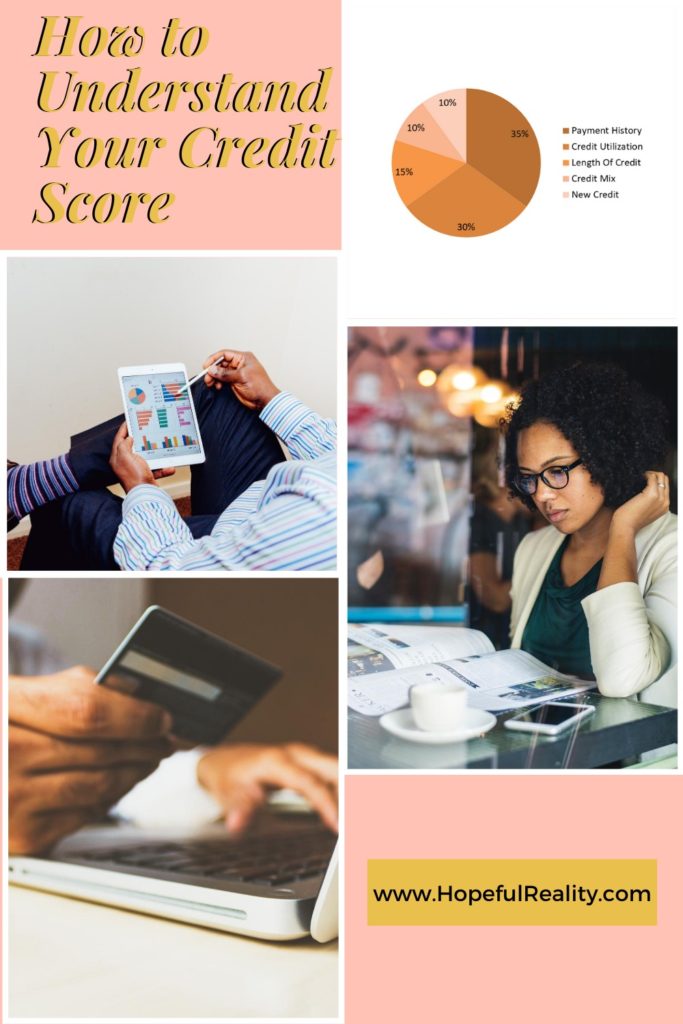

35% is based on your payment history with revolving loans (i.e student loan, mortgage, credit cards, installment loans etc). Now that’s a nice chunk and explains why ya girl is scraping to get in the 700 club. Making ON TIME payments consistently will help keep your score moving up while reported missed payments brings it down. I shared how I was able to remove 12 missed payments off my credit report by using Experian Boost. Have you signed up yet or read about here🤨?

Credit Utilization

30% is based on your credit utilization. Credit utilization is just a fancy way of saying how much you spend using credit. There is a safe rule to not spend more than 30% of your credit limit. For example let’s say you have a credit card with a limit of $100 you don’t want to spend more than $30 on that card if you’re using the safe 30% spend rule. I can’t explain any further because that is as far as my understanding goes 🤣 #itsajourney .

Length of Credit

15% is based on the length of credit history. Your credit history is the length of time an account has been open and the most recent actions on that account. This helps borrowers see your financial behavior. Think about it as a code of conduct grade for your finances. The longer the history the better the score impact. It’s still possible to have a good credit score with little history.

Credit Mix

10% is based on your credit mix. Credit mix is having a variety of revolving loans on your report. Borrowers like to see that you’re able to manage multiple types of payments on time, you are viewed as lower risk.

New Credit

10% is based on new credit. New credit is when you apply to open a new line of credit. Now don’t go applying for multiple credits at once. That will suggest to borrowers that you are high risk.

Action Steps to Take NOW

Step 1: Sign up for a free credit monitoring service to see where you stand. I highly recommend Experian Boost.

Step 2: Analyze your current score and see what area needs improvement (use this post as a reference as you are evaluating your score)

Step 3: After analyzing, read this post on how you can boost your score and apply the tips.

Conclusion

When learning how to understand your credit score it is important to start with the fundamentals. Knowing how the score is calculated will help you analyze your credit from a greater understanding. Personal finance is just that personal. What may be impacting one person’s score may not be the same for yours. Having this general understanding puts power into your hands. Allowing you to make educated moves to improve your credit score. In order to repair or maintain your credit score, it’s important to know what financial decisions cause what impact. Remember your credit is scored by the following measures:

- Payment History 35%

- Credit Utilization 30%

- Length of Credit 15%

- Credit Mix 10%

- New Credit 10%

Talk to me, which percentage do you feel needs the most work?